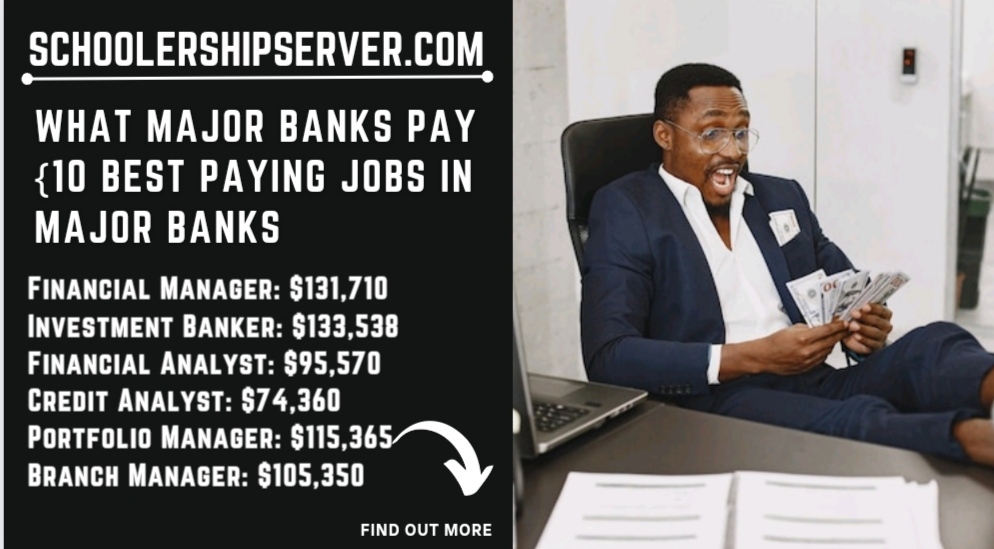

What Do Major Banks Jobs Pay

- Financial Manager: $131,710

- Investment Banker: $133,538

- Financial Analyst: $95,570

- Credit Analyst: $74,360

- Portfolio Manager: $115,365

- Branch Manager: $105,350

- Commercial Loan Officer: $100,670

- Senior Relationship Manager: $120,340

- Compliance Officer: $104,860

- Risk Analyst: $96,550

- Market Research Analyst: $89,640

- Treasury Manager: $112,150

- Chief Financial Officer: $187,200

- Chief Risk Officer: $175,340

- Chief Compliance Officer: $165,350

- Chief Investment Officer: $192,340

- Chief Executive Officer: $250,340

What Are Major Banks

Major banks are the backbone of the financial system in the United States, they play a crucial role in the economy of the country. These financial institutions are in charge of carrying out several crucial tasks, such as lending, investing, and protecting client savings. In this article we will examine the idea of large banks, What Are The Functions, Services Provided By Major Banks, What Are Major Banks in the United States, What are the Different Types of Major Banks?

Major banks, also known as commercial banks or universal banks, are significant financial organizations that offer a wide array of financial services to people, organizations, and governments. Federal and state financial authorities have approved and overseen these institutions, assuring their conformity with rules and laws.

ALSO CHECK ????????

- What Do Consumer Non-durables Jobs Pay {10 Best Paying Jobs In Non-durables}

- How Many Jobs Are Available In Non-durables Goods In 2023

- 10 Of The Best Paying Jobs In The Steel/iron Ore Industry

- How Many Jobs Are Available In Clothing/Shoe/Accessory Stores {10 Best Job’s To Consider} Stores

What Are The Functions, Services Provided By Major Banks

Major banks provide depository services, accepting and protecting deposits from both individuals and companies. Customers can use this feature to safely store their money in checking, savings, or certificate of deposit (CD) accounts while collecting interest and retaining liquidity.

Major Banks are in charge of providing credit to clients, which includes people, small enterprises, and huge corporations. They provide a range of loan products, including mortgages, personal loans, auto loans, and business loans, which support financial transactions and promote economic progress.

Major banks frequently have specialized sections that offer services in this area. In addition to arranging initial public offerings (IPOs), underwriting securities, and mergers and acquisitions, these services also provide corporate clients with financial advising services.

Many big banks provide financial planning units that serve wealthy people and families. To assist clients in increasing and preserving their wealth, these departments include individualized financial planning, investment advising services, estate planning, and asset management.

Major banks typically conduct multinational companies, offering clients access to global financial services and promoting global trade. They provide services such as international wire transfers, letters of credit, foreign exchange, and money for trade.

What Are Major Banks in the United States:

The United States boasts several major banks that are household names across the country. In this segment, we would be looking at a few prominent examples of them:

JPMorgan Chase And Co.: JP Morgan Chase has assets over $3.7 trillion, and happens to be the largest bank in the United States. It delivers a comprehensive scope of financial benefits, comprising consumer and commercial banking, investment banking, and asset management.

Bank Of America Corporation: Bank of America goes on to be one of the “Big Four” banks, this bank operates approximately on consumers and small businesses. It delivers a wide collection of banking and financial services, comprising retail banking, wealth management, and investment banking.

Citigroup Inc.: Citigroup is a multinational financial institution that shows a diverse range of benefits, such as consumer banking, credit cards, corporate banking, and investment banking. It runs in over 160 countries and jurisdictions worldwide.

Wells Fargo And Company: Wells Fargo is known for its comprehensive branch network and offers a comprehensive suite of banking, lending, acquisition, and wealth management benefits. It operates with millions of customers across the United States.

- 10 Best Paying Jobs In Beverages Production/Distribution

- What Do Consumer Non-durables Jobs Pay {10 Best Paying Jobs In Non-durables}

- How Many Jobs Are Available In Major Banks {20 Best Jobs}

Is Major Banks a Good Career Path?

Yes, major banks are a good career path, it is good for their competitive salaries and benefits packages, including health insurance, retirement plans, and paid time off. It’s also considered to be a stable employer, even during economic downturns.

Another reason why is a good career path is it has huge opportunities for advancement, both within any department and across it company. It also offers extensive training and development programs to help its employees upskill and advance their careers.

In Conclusion, Major Banks offer a wide range of jobs in different areas of finance, so there is likely to be a position that is a good fit for your skills and interests.

What are the Different Types of Major Banks?

Major Banks serve numerous different purposes and cater to various segments of the financial industry. In this segment, we would be looking for some common types of major banks:

Retail banks: Retail banks, also referred to as consumer banks or personal banks, focus on serving individual customers and offer standard banking services like credit cards, checking accounts, savings accounts, loans, and mortgages. In general, they maintain a sizable network of branches and ATMs.

Biography Of Shearer West, The Vice Chancellor Of Nottingham University

UPDATED Biography Of Professor Mark E Smith, The Vice Chancellor Of Southampton University

Commercial banks: Commercial banks concentrate on offering large and small companies. They provide services such as trade financing, commercial loans, lines of credit, and treasury management. Commercial banking institutions also provide services to individuals, but they place more emphasis on serving businesses.

Investment Banks: They are financial service providers who focus on serving big companies, institutional investors, and governments. Through tasks like underwriting securities issuances (including initial public offerings or bond offerings), mergers and acquisitions, and other financing methods, they help raise money and provide advisory services for corporate finance strategies.

Central banks: These are government or quasi-governmental bodies in charge of overseeing the banking system and a nation’s financial regulation. They supervise the orderly functioning of the financial system, manage interest rates, print money, and serve as commercial banks’ lenders of last resort.

Cooperative Banks: Customers who frequently involve themselves in a particular community, profession, or industry own and run cooperative banks. They typically serve their members by offering banking services, such as deposits, loans, and other financial items.

Credit Unions: These are member-owned financial cooperatives, similar to cooperative banks. They offer similar services to retail banks, such as mortgages, loans, and savings accounts, but they put more of an emphasis on their members’ needs by charging cheaper fees and offering greater interest rates.

Online banks: Online banks don’t have physical branches and do their business largely online. They provide a variety of banking services, such as loans, savings accounts as well as and checking accounts, but with the ease of digital access and frequently at reduced costs.

Savings Banks: Savings banks have a history of supporting ownership and saving. They offer standard banking services including loans, deposits, and mortgages, frequently putting a focus on encouraging homeownership and financial stability in their local communities.

It’s crucial to remember that different countries and areas may have different bank names and classifications, and some banks may provide a combination of services from many types. In addition, the banking sector is dynamic, and new bank varieties business models could appear in the future.

Reason Why Major Banks Is A Good Career Path

Yes, major banks are a good career path, it is good for competitive salaries and benefits packages, including health insurance, retirement plans, and paid time off. It’s also considered to be a stable employer, even during economic downturns.

Another reason why it is a good career path is its huge opportunities for advancement, both within any department and across its company. It also offers extensive training and development programs to help its employees upskill and advance their careers.

How Many Jobs Are Available In Major Banks

The banking sector is one of the strongest pillars of the society and economy. So, they are thousands of jobs in it. They offer many financial services to enterprises and individuals and you can find high-paying jobs in the major banks. If you’re looking forward to exploring the major banks industry, then, knowing the most common jobs is a great step.

What Are The Best Paid Jobs In Major Banks

- Financial Manager: $131,710

- Investment Banker: $133,538

- Financial Analyst: $95,570

- Credit Analyst: $74,360

- Portfolio Manager: $115,365

- Branch Manager: $105,350

- Commercial Loan Officer: $100,670

- Senior Relationship Manager: $120,340

- Compliance Officer: $104,860

- Risk Analyst: $96,550

- Market Research Analyst: $89,640

- Treasury Manager: $112,150

- Chief Financial Officer: $187,200

- Chief Risk Officer: $175,340

- Chief Compliance Officer: $165,350

- Chief Investment Officer: $192,340

- Chief Executive Officer: $250,340

What Are The Highest Paid Jobs In Major Banks?

Chief Executive Officer (CEO): The CEO is the top executive, and the CEO is the man who sees the overall direction and performance of the Major bank. Their compensation often includes a significant salary, bonuses, and stock options.

Their compensation often includes a significant salary, bonuses, and stock options.

Investment Banker: Investment bankers work on complex financial transactions such as mergers and acquisitions, initial public offerings (IPOs), and corporate finance. They earn substantial salaries and bonuses based on their deals’ success and their ability to generate

They earn substantial salaries and bonuses based on their deals’ success and their ability to generate

Managing Director: Managing directors hold senior leadership positions within the bank, overseeing specific divisions or business units. They are responsible for strategy implementation, client relationships, and driving business growth. Their compensation typically includes a high base salary, performance-based bonuses, and equity-based incentives.

They are responsible for strategy implementation, client relationships, and driving business growth. Their compensation typically includes a high base salary, performance-based bonuses, and equity-based incentives.

Risk Manager: Risk managers assess and mitigate various types of risk faced by the bank, such as credit risk, market risk, operational risk, and regulatory compliance. They play a crucial role in maintaining the bank’s stability and managing potential risks that could impact its financial health.

They play a crucial role in maintaining the bank’s stability and managing potential risks that could impact its financial health.

Financial manager: Financial managers oversee the financial operations of a company or organization. They typically have a bachelor’s degree in finance, accounting, or a related field and several years of experience in the financial industry. The average salary for a financial manager in the United States is \$131,710 per year.

They typically have a bachelor’s degree in finance, accounting, or a related field and several years of experience in the financial industry. The average salary for a financial manager in the United States is \$131,710 per year.

As you can see, the highest-paying jobs in major banks are all in the finance field. These jobs typically require a bachelor’s degree in finance, economics, or a related field and several years of experience in the financial industry. They also involve a great deal of responsibility and can be quite stressful. However, they also offer the potential for high salaries and lucrative bonuses.

How Many Jobs Are Available In Clothing/Shoe/Accessory Stores {10 Best Job’s To Consider} Stores